An astute new article from Gracenote puts its finger on the one strategy that no streaming player has yet fully leveraged: it’s too hard to find the programs you are going to like the most.

The strategy that the top five global SVODs – Amazon Prime Video, Apple TV+, Disney+, Netflix and Paramount+ - have all been using is to amass the largest libraries of choices: the amount of available SVOD content has grown 5.3% in just the past three months. Each of them now has over a half million program choices.

But as the article shrewdly observes:

“The perpetually growing abundance of content amplifies negative sentiment from audiences about the difficulties associated with finding something to watch. This is especially problematic when viewers start searching without having any idea of what they want to watch. Mid-2024 research from TiVo, for example, found that only 15.5% of people in North America and 16% of people in the U.K. know what they want to watch when they start a streaming session.

The difficulty in finding the right content is affecting churn rates, as Deloitte’s 2024 Digital Media Survey found that 36% of Americans don’t believe the content on their SVOD services is worth the money they spend. Similarly, A Google-commissioned Harris Poll survey at the end of 2023 found that 48% of streaming subscribers canceled a service because they couldn’t find something to watch.”

Adding more choices, the current main strategy actually exacerbates the problem.

None of the competitors has made a concerted and successful effort to provide superb program recommendations personalized for the person or co-viewing group that is assembled to watch something. As Michael Collette, CEO of Run3TV, which is developing the industry app for NextGen TV, says: “Most program recommenders are mediocre.”

This is not a new finding, it began to appear around 2019. In July of that year, a Nielsen survey found that, having tried them and come away disappointed, “only 26% use today’s recommenders… 58% give up searching and go back to their favorite channels… 21% decide not to watch and do another activity instead of TV.”

A 24-country study done by Ericsson released about the same time found that the average industrialized nation adult spends 23 minutes a day trying to find the right show to watch (and usually don’t find it) – and commented that “this is 1.3 years out of the life of someone who lives to 80.”

Why are most recommenders falling short? It’s because of the data and the data science that they use.

Vastly underestimating the importance of making program discovery quick and easy, the tendency is to use off-the-shelf algorithms. The most common one is collaborative filtering. The method requires some weeks to build up a model, so it can proclaim: “People who watched the program you just watched also watched X, Y, and Z”. This seems like a pretty good idea (other than the long latency) but it is really very superficial. It ignores the 80% of the potential audience who never heard of the average show. Screen Engine has been reporting for years now that the awareness of new shows is that low. If everyone was aware of every show, collaborative filtering would work better than it has in the past, but not well enough for an SVOD to take the lead over its competitors.

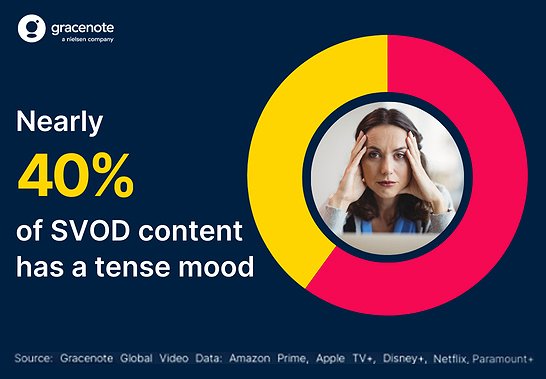

Others have tried to use reviews as a basis for making recommendations, but this utterly fails the personalization test. A very common method is to use judgment to cluster programs into groups that are like program genres, but more granular. The leader in the field of video metadata in the world today is Gracenote, owned by Nielsen. Gracenote uses highly granular subgenres and also about 300 terms it calls “moods”, and has the largest database in the world. The importance of coding using psychological variables such as Gracenote moods, themes, scenarios, and subject-issues cannot be overestimated in the current SVOD battleground. The following graphic from the article demonstrates the nuanced psychological metadata that is the direction in which program discoverability has to go.

Another approach which uses psychological metadata is the one that I’ve been developing over the years and first field tested in 1997, today exclusively licensed to a company I co-founded called RMT, of which Audrey Steele is the President and Bill McKenna the CEO. The 1997 field trial found 90% satisfaction with that recommender. This approach started with over ten thousand metadata variables and used an early proprietary AI program recommender deployed in the largest MVPD at the time, TCI (John Malone CEO) which used machine learning to identify the 265 variables most predictive of the loyal adoption of a TV series recommended when it had never been watched before by the viewers. These psychological variables turned out to be of five types: human values/motivations, character and personality traits of the characters/hosts, moods/emotions, situations, and content descriptors. There is only a slight overlap with Gracenote moods, and for the most part, the two methods appear to complement one another.

There will be a first-mover advantage to the first of the SVODs/AVODs who takes advantage of the psychological metadata now available to create what will be one of the new wonders of the world: a program recommender that takes less than a minute to use and which is rarely wrong about suggesting a program you will love. The groundswell from satisfied users will go viral. The competitors will hope to catch up, but the awareness of the leader will have a lasting effect on who wins the race to the top.

This will be especially valuable to the SVODs/AVODs in the part of the footprint where there is advertising, because the ads can be metatagged the same as the programs, and matching on these psychological metatags has been proven to increase the sales effect of ads an average of +36% (NCS with RMT metadata), the effect on first brand mention +62% (605 with RMT metadata).

People are everyone’s prospect customers (not homes, not devices). People have motivations and feelings and tend to watch programs with characters that represent their aspirational selves, according to Wharton’s Dr. Americus Reed, so it stands to reason that psychological variables are going to be the stuff you need to quickly identify the program to recommend to a specific viewer or group of viewers co-viewing.

Total streaming subscribers are now 99% of US population and about 2 billion globally, about a quarter of the whole human race, and annual streaming revenue is estimated at $200 billion in 2025. In the US, the number of streaming services per household is 2.9. The size of the prize is even huger than this because streaming is still rolling out. It addresses all screen devices owned by consumers, including smartphones, which number 7.5 billion globally, about 92% of the human race.

For want of a nail…

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of