Practical Implications of the Cognition Quest So Far

It really started long ago – the advertising industry’s cognition quest. David Ogilvy spent time contemplating how the human mind works and how ads work, when they do, upon the mind. He was not the only one.

I sat at a table filled with the top creative people at a French restaurant in Manhattan. Rosser Reeves had called the party together and even Bill Bernbach was there. All we talked about was the cognition quest. How did advertising work. The discussion wasn’t always peaches and cream because in the arrogance of my youth I kept bringing up the media effect.

That was many years ago. The Advertising Research Foundation deserves most of the credit for keeping the flame alive. Now they even have a Cognition Council on which I’m honored to serve.

It was the ARF Model that kept the quest alive. ARF also contributed by bringing neuro into the foreground, and today, by validating attention so as to bring out its best.

Between the innovative flowering of media and advertising research, and the ARF, MRC, and other leading industry organizations, here is what we have learned so far that is actionable:

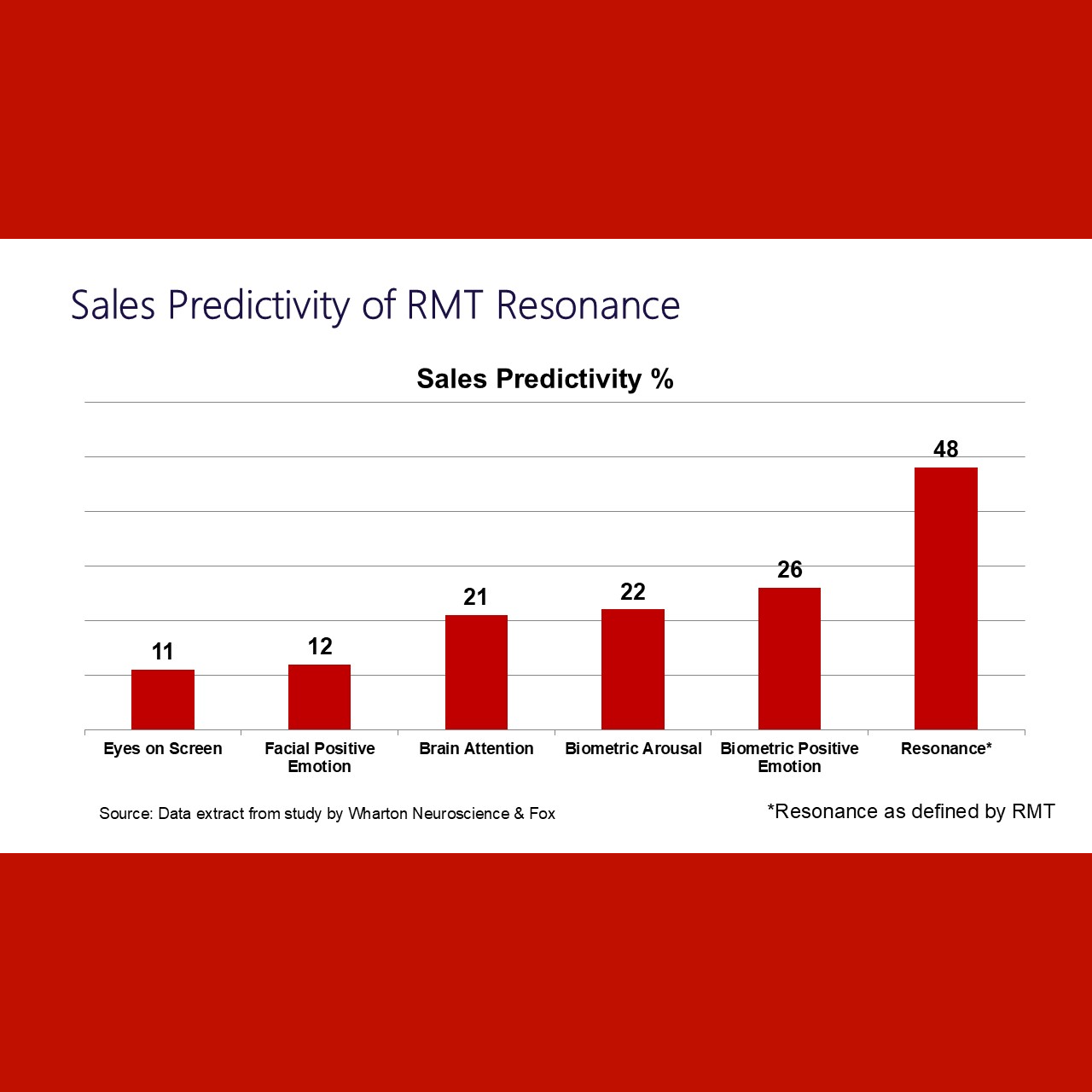

- You do want to use both attention and resonance in order to cover branding and sales effects. ARF has put out an Atlas of the 30 or so attention suppliers, and resonance as a concept is currently being practiced by RMT, Wurl, Magid Emotional DNA, and Marketcast (any others please let me know). In the next post I’ll try to put together a chart of how they complement one another.

The reason you want to do this is because without it, you will be simply buying the cheapest impressions and not taking advantage of context and ad-person resonance effects, so you will underperform on branding and sales – on every funnel metric – compared to what your creative and media budget could have done.

Attention boosts discoverability, while Resonance fosters deeper connections that lead to better outcomes.

- In-market testing will be the only way to know for certain, but it is likely that you are overinvesting in digital. This is not to damn that media type, which is essential and has added considerable value to the practice of science-based advertising (while also having a looming dark side). It is to call out the existence of two things which are not being paid adequate attention:

- Saturation effect. If you buy too much of a media type, its marginal ROAS will sink to zero. This is exactly what has happened: the buy side has sailed past saturation top-out levels without noticing them. They were noticed by the Bill Harvey Consulting 2014-2023 MMM Study of ROAS, the largest in history, sponsored by FOX.

- Television including CTV has more impact throughout the funnel than digital on average, and in that sense their average CPMs are fair. However, by ignoring media impact differences, the buy side has been going for the cheapest impressions by over-allocating to digital, putting as little money as possible into the higher CPMs. Which is ignoring the fact that those higher CPMs are justified: BHC MMM showed that fewer than one in five brands studied gained market share since 2014, as money was held back from TV. These were all major brands in CPG, Auto, QSR, CE, computers, and videogame consoles. For big mature national brands, the only way to sustain brand growth is by focusing on impact not price.

The attention studies have definitely proved this point more than adequately. The Meta RealEyes Eye Square BHC study showed that streaming has much higher attention effect than scrolling or short form. Every attention researcher, Amplified Intelligence, Adelaide, RealEyes, Eye Square, ChilmarkDigital, Viomba, Lumen, and all the others have found the same thing, it is the way it is, and marketers must take impact indices into account in media decisions or their brands will stay stalled as the new brands take over. That would not be good for America or for the world, but especially not for the companies themselves and their employees and suppliers and stockholders.

It is not just the BHC MMM study and the attention studies. TRA and NCS both published compelling findings of greater ROI for TV over digital (except for premium digital video). That’s sales, not just attention.

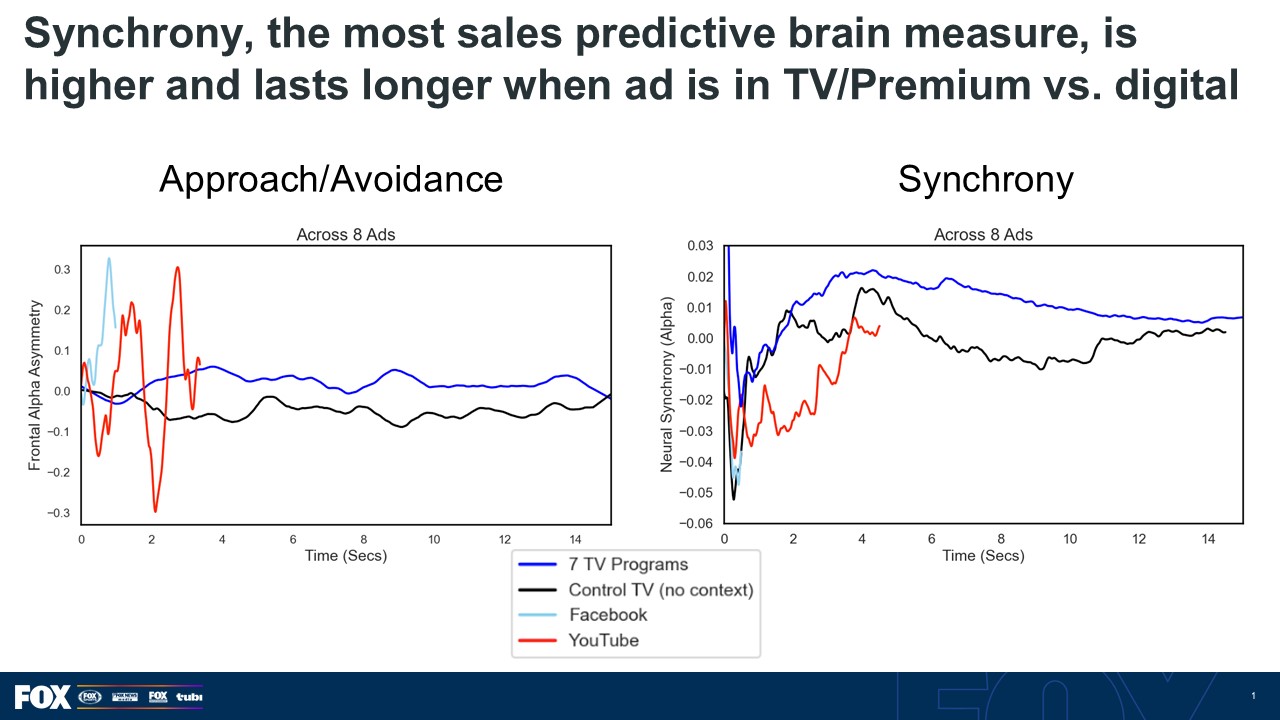

The most recent work has been done by Wharton Neuroscience and BHC, sponsored by FOX. It focuses on the most sales-predictive measures at the industry’s disposal, three specific patterns of brainwaves that have prediction scores (Adjusted R Squared) of .8 to .9 (memory, approach, synchrony). These waves tend to be higher and last much longer for TV than for digital as shown in this slide:

The evidence is unmistakable, plus common sense would tell you the same thing. We are talking about investments of billions of dollars. It is time to get serious about marketing.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.