Brands Leaving Money on the Table by Ignoring Context Effects, Recency and Factual Purchaser Targeting

If you are a brand that is not ignoring these things, please contact me.

The Nielsen (you’ll recall they are a client of mine) ROAS outcomes measurement system NCSolutions (a separate company joint venture with Nielsen majority ownership) has just released findings from its newly updated “Five Keys To Advertising Effectiveness” study. The original study was released in 2017 and showed the proportion of incremental sales produced by Brand, Creative, Targeting, Reach and Recency effects. The major shift in spending from TV to digital since 2017 plus the pandemic and the growing importance of Gen Z have all contributed to seismic shifts in the relative importance of these five factors.

Context Effects

In the 2017 report there was also a category called context effects which earned only 2% of the explanatory power for incremental sales credited to media advertising. In the 2023 report this Context category disappears entirely. We are not surprised. Advertisers and agencies have ignored context effects and fail to activate with optimization of context effects.

In the 2017 study, the context effects contribution was based on Nielsen program types, which could only explain 2% of incremental sales.

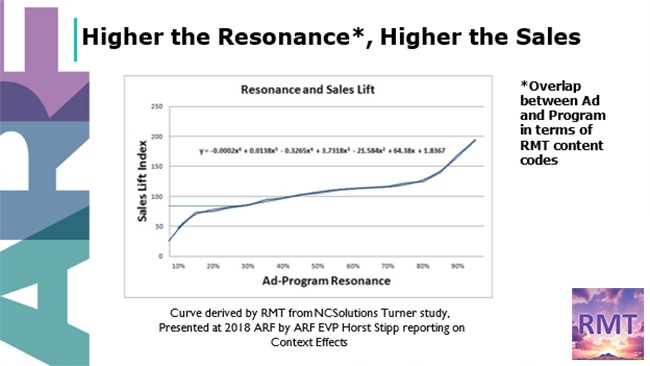

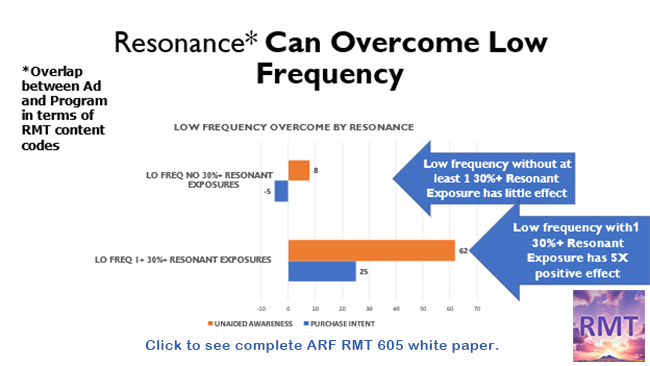

In an NCS study reported in 2018 and sponsored by Turner, it was found that using RMT content coding to analyze the duplication of content codes between TV ad and TV program, if the buy side maximized such overlap, incremental sales effect could be increased an average of +36%. Since virtually no one is doing this, it does not show up in the latest NCS “Five Keys” roundup. If it had been used in the 450 cross-media campaigns in the latest study, it would have showed up as a strong “Sixth Key” and the total incremental sales covered in the study would have been around +36% higher.

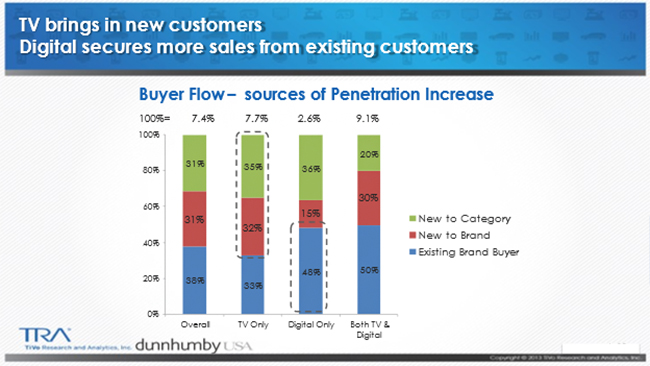

An econometric study conducted by Bill Harvey Consulting for FOX covering about three trillion dollars in brand sales and about fifty billion in adspend, shows that since 2014, as brands shifted most dollars from TV to digital, only one in five brands grew market share. This is because digital is not as good as TV in bringing in new customers, so that the more money shifted out of TV and into digital, the fewer new customers will be acquired, and more of advertising’s work will be done on a reminder basis in getting more money out of existing brand loyals. This is shown in a TRA Comcast study:

Why would this be so? Why would digital tend to have great reminder effect but weak ability to grow brands to new customers? It’s explained in my MediaVillage In Terms of ROI article of August 2nd. Digital excels at getting 1-2 seconds of concentrated attention, which is enough to refresh in an existing customer’s mind, a brand that is already being bought. But it’s not enough duration of attention to tell a story and evoke emotion, both of which are necessary for persuasion and acquisition of a new customer. Television can do this, and another RMT study shows that even a single impression can have this effect where there is high overlap in RMT content codes between an ad and a TV program.

Ignoring the difference in the way TV and digital advertising works is another form of context blindness, because TV and digital are high level contexts. RMT’s work is at the more granular context level of TV programs and specific websites/apps and how much their psychological characteristics (265 RMT content codes called DriverTags) overlap with the client’s ad. Both types of context effect should be taken into consideration in media optimization.

Neither form of context effect is being effectively considered today by 99% of advertisers. The implicit assumption is that “it can’t make that much of a difference” to just get the lowest CPMs – the essence of digital’s main appeal. Lowest price is easy to explain and clients tend to not fault it. A better approach would be to consider all of the evidence at the sales level. Minimizing CPM with context (both types) based guard rails would not be a difficult algorithm to execute. We have enough evidence now to scientifically and objectively state with certainty that it will definitely increase brand growth.

NCS in its new update of “Five Keys” reports the secular effects of the shift to digital, while also noting the effects of the pandemic and Gen Z. Let’s review the changes for each of the Keys, while also looking at it by TV vs. digital where NCS has supplied the data.

Creative

In 2017 and again in 2023, Creative delivers 49% of incremental sales effect. No significant difference here between TV and digital, they are both equally dependent upon the ad creative.

This is the number one driver of incremental sales made by advertising. NCS provides many valuable insights including:

“As this younger generation gains purchasing power, they’ll be looking for unique advertising creative that keeps them entertained and laughing. More than half (52%) of Gen Zers prefer creative and entertaining advertising, and 43% prefer ads to be humorous. Ads with a social message also resonate well with Gen Z. They’re three times more likely to engage with advertising if it includes social messaging that’s aligned with their beliefs. When brands are closely attuned to audience interests and desires, they’ll find it much easier to raise the bar on creative and achieve better outcomes.”

Brand

In 2017 this was the third most powerful factor (Reach was second; it was still the Age Of Television Dominance). In 2023 Brand has become the second most powerful variable in generating incremental sales, mostly based on brand loyalty (also favoring high penetration brands and brands with a higher share of wallet). The Brand factor went from 15% to 21% of the incremental sales effect.

“Incremental” does not mean “new to brand.” It means “credited to media advertising as incremental to the sales predicted to have been made anyway without advertising.”

This Brand shift in sales weight from 15% to 21% was a big change. “The study found that brands with the highest levels of consumer loyalty had twice the incremental sales as brands with low to average loyalty levels,” the NCS downloadable eBook reports.

The importance of Brand was far greater in digital than in TV. In TV, Brand is still down around where TV+digital was in 2017 at 13%. In digital it’s almost double that at 25%. With the composite figure being 21%, it looks like the change in the importance of Brand has really occurred because of the shift in dollars to digital.

Digital and Brand logically go together because digital does its best work against current brand users.

Note that in this study, CTV is classified within digital, including the streaming of network television programs. It’s likely that a finer breakout of the two types of CTV – the one which is very much like linear and the other which involves user generated content and the “Skip in 5-4-3-2-1” protocol – show significant differences from one another in their ability to generate incremental sales.

Reach

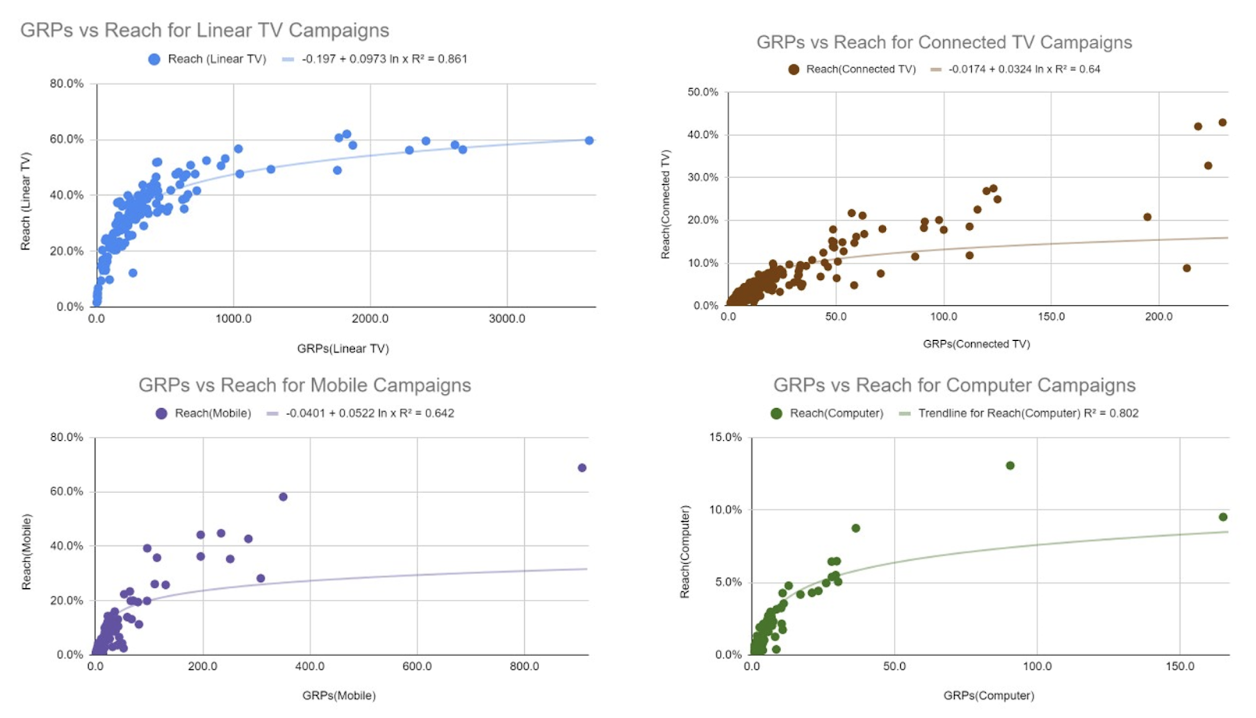

Reach had been the second most powerful driver back in 2017 during the sunset of the Age of Television Dominance at 22%. Now it’s dropped to 14% in the Age of Digital Dominance. There’s good reason for that. With advertisers spending most of their money in digital to get the low CPMs, reach has gone way down, and the Cost Per Reach Point (CPRP) has gone astronomical. TV generally beats digital in CPRP, a fact apparently little known or understood. The low reach ceilings achievable by digital are shown by the analysis I did of Nielsen ONE data (2224 cross-platform campaigns in 2022) that I reported in my MediaVillage In Terms of ROI article of April 27, 2023:

NCS reports that the Media Keys Reach, Targeting and Recency are 39% of incremental sales effect for TV but are only 26% for digital. This in itself is a context effect showing that the TV media have 50% higher lift on incremental sales than digital media have. Most of this must be against new to brand buyers that TV can create far more frequently than digital can at any price and scale.

Targeting

Targeting went from 9% to 11% of incremental sales effect. This shows how slowly brands and agencies are converting over from sex/age to something else. It’s also a reflection on the noise in lookalikes and the under-utilization of factual purchaser targeting.

In TV Targeting, Reach and Recency (reported as a cluster called the Media factor) combined are 39%, vs. 26% for digital, as cited above. This raises an interesting question I shall ask Nielsen and report here later: how do TV and digital compare on Targeting alone, Reach alone, Recency alone? Will let you know.

Recency

Recency was 5% in 2017 and is now still 5%. In a way, this is the universe telling Joel Rubinson to brush off his IRI Viant NCS study and get out there and scream louder. He showed that triple digit increases in ROAS lay in this dimension if practitioners were more open to finally changing the “Mad Men Era methods” and more fully exploiting media addressability. Targeting factual purchasers and allocating among loyals and occasionals optimally was what TRA taught, and Joel (an Erwin Ephron protegee) and Leslie Wood continue that work, while Joel added the shopping cycle prediction method to recency.

Leslie had done the earliest UPC analytics using ScanAmerica which documented high sales effects for getting an impression to a person within 24 hours of a shopping trip, and especially if you can, getting them twice in that window.

Like context effects, the recency lesson, written by Erwin Ephron himself, is still being under-considered. Today consideration means an optimization algorithm with weights for media types, and using addressable to target people coming up on their visible shopping cycle, as Joel did.

For CPG brands these are the three most important things I can say to you today. For brand growth you must focus your attention on:

- factual purchaser targeting of occasionals and loyals,

- context effects (at both levels), and

- recency.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.