If you are a brand that is not ignoring these things, please contact me.

The Nielsen (you’ll recall they are a client of mine) ROAS outcomes measurement system NCSolutions (a separate company joint venture with Nielsen majority ownership) has just released findings from its newly updated “Five Keys To Advertising Effectiveness” study. The original study was released in 2017 and showed the proportion of incremental sales produced by Brand, Creative, Targeting, Reach and Recency effects. The major shift in spending from TV to digital since 2017 plus the pandemic and the growing importance of Gen Z have all contributed to seismic shifts in the relative importance of these five factors.

Context Effects

In the 2017 report there was also a category called context effects which earned only 2% of the explanatory power for incremental sales credited to media advertising. In the 2023 report this Context category disappears entirely. We are not surprised. Advertisers and agencies have ignored context effects and fail to activate with optimization of context effects.

In the 2017 study, the context effects contribution was based on Nielsen program types, which could only explain 2% of incremental sales.

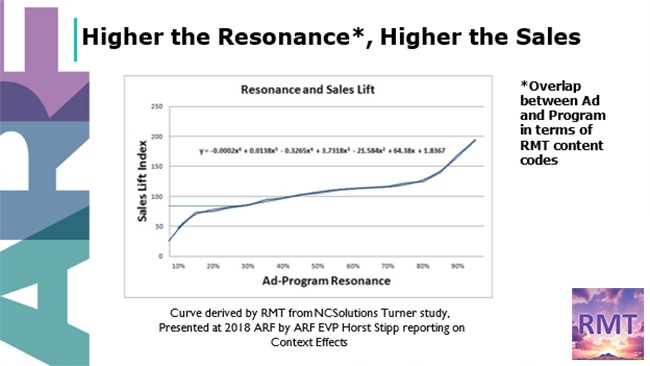

In an NCS study reported in 2018 and sponsored by Turner, it was found that using RMT content coding to analyze the duplication of content codes between TV ad and TV program, if the buy side maximized such overlap, incremental sales effect could be increased an average of +36%. Since virtually no one is doing this, it does not show up in the latest NCS “Five Keys” roundup. If it had been used in the 450 cross-media campaigns in the latest study, it would have showed up as a strong “Sixth Key” and the total incremental sales covered in the study would have been around +36% higher.

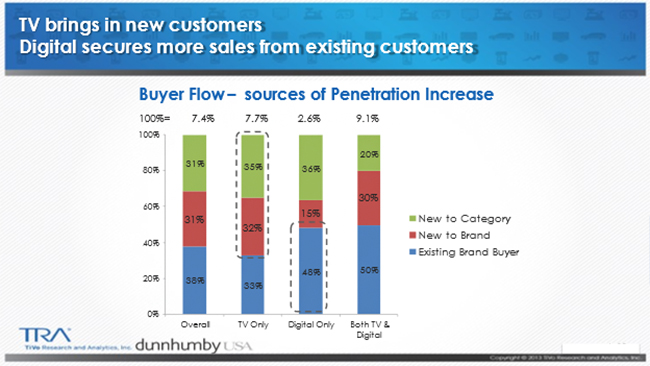

An econometric study conducted by Bill Harvey Consulting for FOX covering about three trillion dollars in brand sales and about fifty billion in adspend, shows that since 2014, as brands shifted most dollars from TV to digital, only one in five brands grew market share. This is because digital is not as good as TV in bringing in new customers, so that the more money shifted out of TV and into digital, the fewer new customers will be acquired, and more of advertising’s work will be done on a reminder basis in getting more money out of existing brand loyals. This is shown in a TRA Comcast study:

Why would this be so? Why would digital tend to have great reminder effect but weak ability to grow brands to new customers? It’s explained in my MediaVillage In Terms of ROI article of August 2nd. Digital excels at getting 1-2 seconds of concentrated attention, which is enough to refresh in an existing customer’s mind, a brand that is already being bought. But it’s not enough duration of attention to tell a story and evoke emotion, both of which are necessary for persuasion and acquisition of a new customer. Television can do this, and another RMT study shows that even a single impression can have this effect where there is high overlap in RMT content codes between an ad and a TV program.

Targeting went from 9% to 11% of incremental sales effect. This shows how slowly brands and agencies are converting over from sex/age to something else. It’s also a reflection on the noise in lookalikes and the under-utilization of factual purchaser targeting.

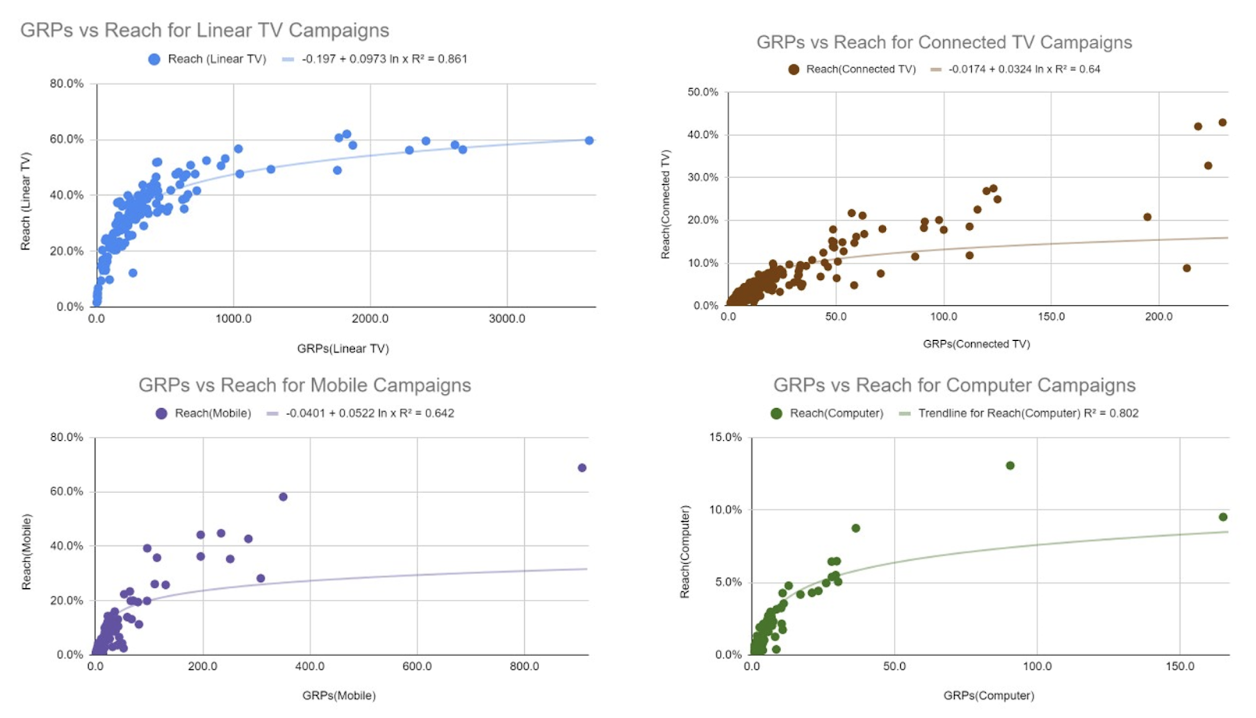

In TV Targeting, Reach and Recency (reported as a cluster called the Media factor) combined are 39%, vs. 26% for digital, as cited above. This raises an interesting question I shall ask Nielsen and report here later: how do TV and digital compare on Targeting alone, Reach alone, Recency alone? Will let you know.

Recency

Recency was 5% in 2017 and is now still 5%. In a way, this is the universe telling Joel Rubinson to brush off his IRI Viant NCS study and get out there and scream louder. He showed that triple digit increases in ROAS lay in this dimension if practitioners were more open to finally changing the “Mad Men Era methods” and more fully exploiting media addressability. Targeting factual purchasers and allocating among loyals and occasionals optimally was what TRA taught, and Joel (an Erwin Ephron protegee) and Leslie Wood continue that work, while Joel added the shopping cycle prediction method to recency.

Leslie had done the earliest UPC analytics using ScanAmerica which documented high sales effects for getting an impression to a person within 24 hours of a shopping trip, and especially if you can, getting them twice in that window.

Like context effects, the recency lesson, written by Erwin Ephron himself, is still being under-considered. Today consideration means an optimization algorithm with weights for media types, and using addressable to target people coming up on their visible shopping cycle, as Joel did.

For CPG brands these are the three most important things I can say to you today. For brand growth you must focus your attention on:

- factual purchaser targeting of occasionals and loyals,

- context effects (at both levels), and

- recency.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of