2025 Advertising Spending Forecasts: A Detailed Look at Growth Categories

The Myers Report, now in its 40th year, recently published its annual survey results, conducted in collaboration with the ANA, 4A’s, and leading media agencies including Publicis, IPG Mediabrands, dentsu, GroupM, Canvas, and Active International. The survey, conducted in July 2024 among 3,500 advertising and media decision-makers, provides an authoritative view on the categories poised for growth in 2025. This data reflects a nuanced understanding of media budgets and emerging trends, focusing on key media categories such as CTV/Streaming, 1st Party Data-Based Decisions, and Influencer Media.

Key Media Categories for Growth in 2025

- CTV/Streaming/OTT Video

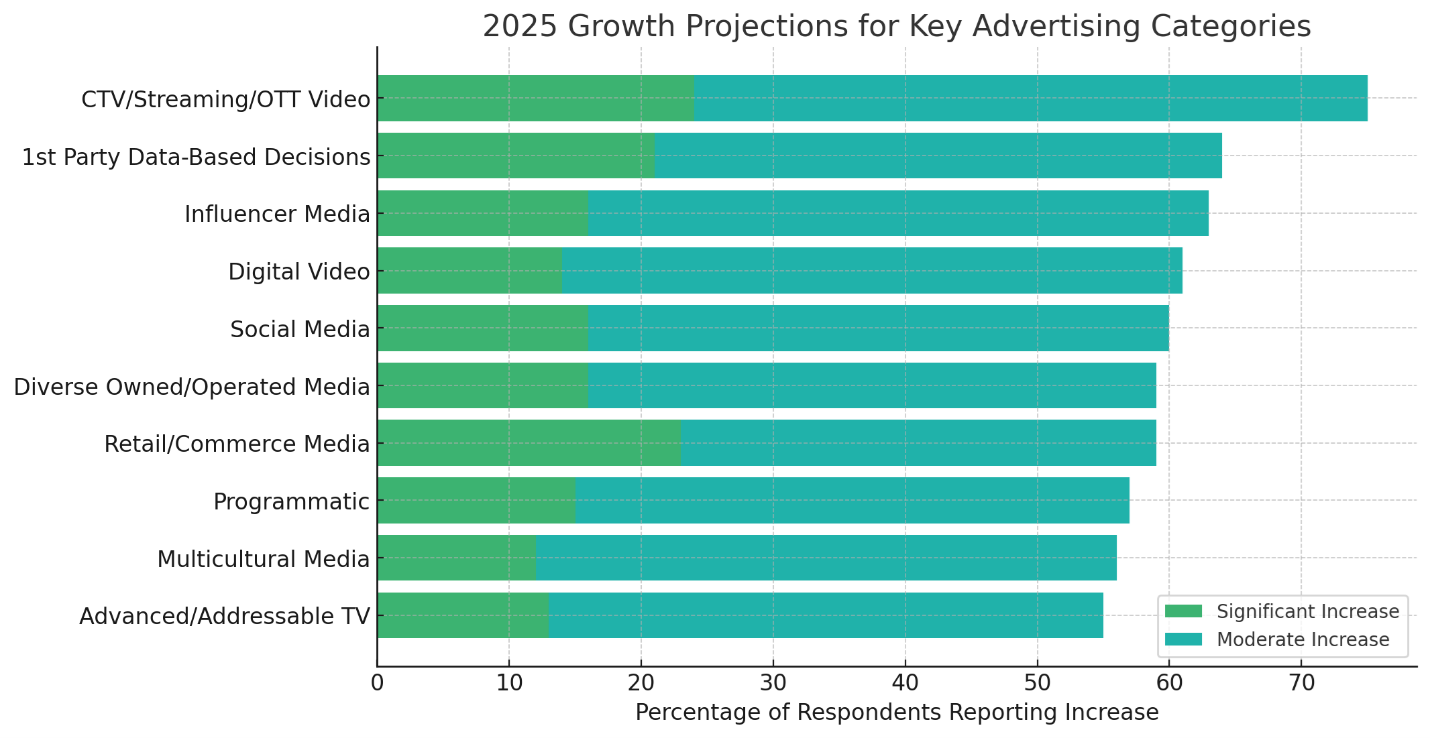

- Forecasted Growth: With 24% of respondents indicating a significant increase and 51% noting moderate growth, CTV/Streaming/OTT Video continues to lead as a top growth category. This trend aligns with eMarketer’s projections, which estimate that digital video ad spending will grow by 13% in 2025, driven largely by consumer migration to streaming platforms.

- Industry Insight: According to a recent report from Wall Street Journal, advertisers view streaming as a more measurable and targetable option, making it increasingly attractive for budget allocation.

- 1st Party Data-Based Decisions

- Forecasted Growth: 21% of respondents expect significant growth in this category, with an additional 43% noting moderate growth. As privacy regulations tighten, brands are pivoting to leverage 1st party data to enhance personalization and performance measurement.

- Corroboration: A recent IPG Mediabrands study found that 80% of brands plan to increase their reliance on 1st party data by 2025, underscoring this shift toward data-driven decision-making.

- Influencer Media

- Forecasted Growth: Influencer Media remains robust, with 16% of respondents expecting a significant increase and 47% projecting moderate growth. Influencer marketing is increasingly integrated into broader advertising strategies, especially as brands seek authentic engagement.

- Expert Insight: eMarketer predicts influencer marketing will exceed $21 billion globally in 2025, with brands utilizing influencers not only on social media but also in omnichannel campaigns.

- Digital Video

- Forecasted Growth: This category shows steady growth, with 14% of respondents reporting significant increases and 47% moderate growth. Digital video remains central to many brands’ media strategies, given its versatility and reach.

- Industry View: Analysts at Morgan Stanley highlight digital video as a critical area of ad spend as brands shift away from linear TV toward more dynamic, targeted video formats.

- Social Media

- Forecasted Growth: Social Media continues to capture budgets, with 16% of respondents expecting significant growth and 44% moderate increases. The shift reflects brands’ continued reliance on social platforms to reach and engage diverse audiences.

- Market Context: According to GroupM’s latest report, social media ad spend will maintain double-digit growth in 2025, as brands increasingly prioritize platforms like TikTok and Instagram for younger demographics.

- Diverse Owned/Operated Media

- Forecasted Growth: With 16% indicating significant increases and 43% moderate growth, diverse-owned media is gaining momentum as brands commit to inclusivity and support for diverse creators.

- Supporting Data: A Publicis study reveals that 70% of advertisers plan to increase spending on diverse-owned media, reflecting a growing focus on DEI initiatives in marketing.

- Retail/Commerce Media

- Forecasted Growth: With 23% of respondents anticipating significant increases, retail media channels are emerging as valuable platforms, enabling advertisers to target consumers close to the point of purchase.

- Market Insight: eMarketer forecasts that retail media ad spend will reach $45 billion by 2025, making it a critical component of omnichannel strategies.

- Programmatic

- Forecasted Growth: Programmatic advertising sees sustained interest, with 15% reporting significant increases. Automated ad buying continues to offer efficiencies and audience targeting capabilities that remain attractive for brands.

- Commentary: dentsu’s programmatic report indicates that 90% of brands plan to use programmatic buying to enhance the efficiency of their digital ad strategies in 2025.

- Multicultural Media

- Forecasted Growth: Multicultural media shows promising growth, with 12% of respondents indicating significant increases and 44% moderate growth. Brands recognize the importance of connecting authentically with multicultural audiences, particularly Hispanic, Black, and Asian communities.

- Industry Perspective: According to Donna Speciale, President of U.S. Advertising Sales at TelevisaUnivision, “Investing in multicultural media is essential for brands looking to drive genuine connections with diverse audiences. It’s a strategic imperative that reflects America’s changing demographics.”

- Advanced/Addressable TV

- Forecasted Growth: Addressable TV maintains its position as a growth category, with 13% expecting significant increases and 42% anticipating moderate growth. Addressable advertising enables precise targeting, which is increasingly important as linear TV audiences’ fragment.

- Analyst Perspective: A Magna Global report projects that addressable TV spending will increase by 15% in 2025, driven by brands’ desire to achieve more granular targeting in TV advertising.

Jack Myers commented, “The Myers Report has been a consistent and reliable source of data in the advertising and media industry for four decades. This year’s survey data reflects a continued evolution in ad spending priorities, with digital, streaming, and multicultural media at the forefront. We’re seeing an industry-wide commitment to not only drive business results but also align with social values by supporting diverse and multicultural media outlets.”

2025 Growth Projections for Key Advertising Categories

2025 Growth Projections for Key Advertising Categories: This chart illustrates the percentage of respondents who forecast significant and moderate budget increases across key advertising categories. CTV/Streaming/OTT Video leads in projected growth, followed closely by categories such as 1st Party Data-Based Decisions, Influencer Media, and Social Media.